The article provides a comprehensive comparison of medical device regulations across Latin America, underscoring the distinct frameworks established by governing bodies such as:

It highlights that, despite ongoing efforts to harmonize regulations and streamline processes, significant challenges persist. These challenges include:

These factors directly impact market access for Medtech companies operating in the region. Understanding these regulatory landscapes is crucial for stakeholders aiming to navigate the Medtech sector effectively.

The landscape of medical device regulations in Latin America is a complex tapestry of rules and procedures, shaped by diverse governing bodies across the region. As companies strive to introduce innovative technologies, understanding these regulatory frameworks is crucial for success. However, navigating the intricacies of compliance and market access poses significant challenges, including varying timelines and documentation requirements.

How can Medtech firms effectively maneuver through these obstacles to capitalize on the burgeoning opportunities in Latin America’s medical device market?

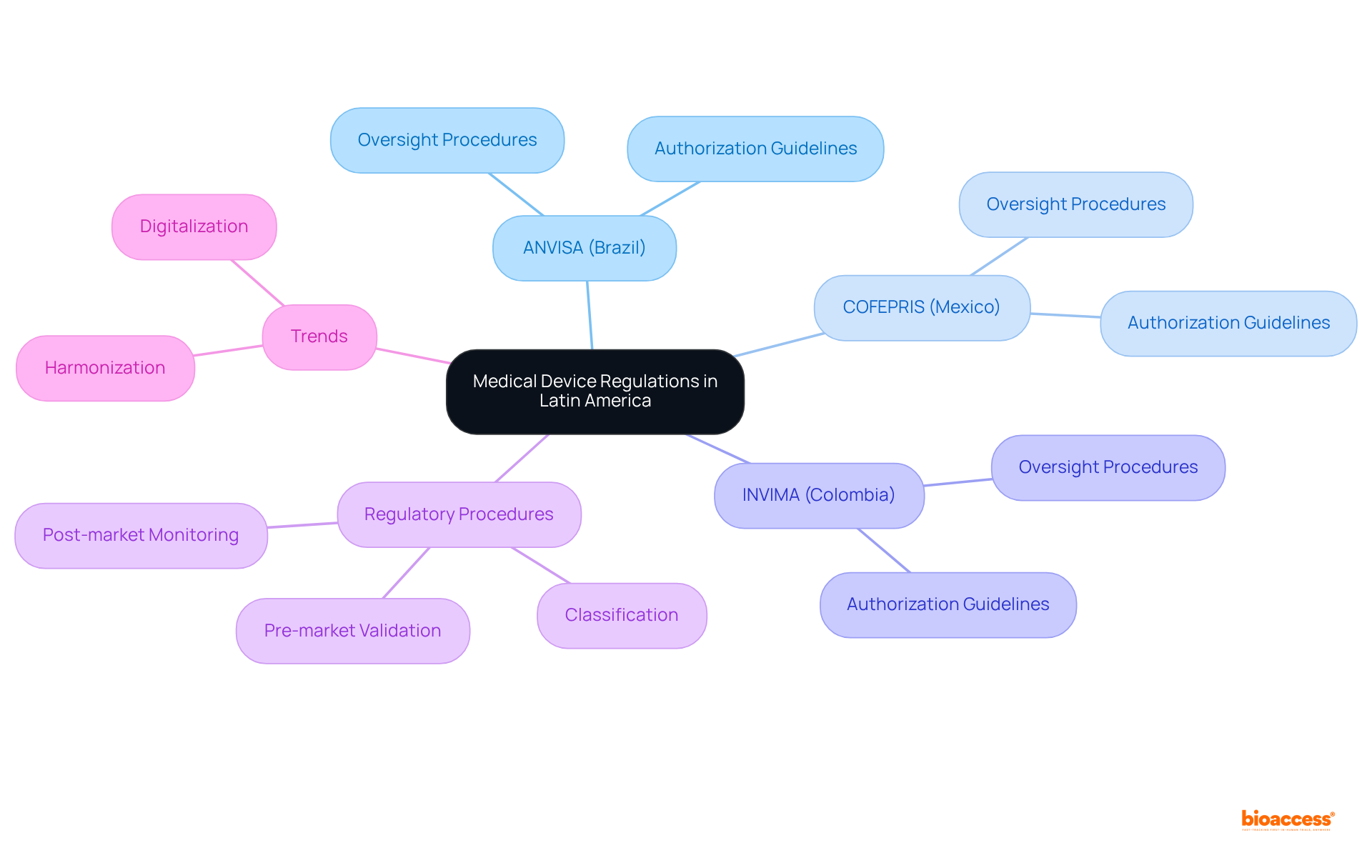

When Latin America medical device regulations are compared, it becomes clear that the governing framework for medical equipment is intricate and varies significantly among nations. Key governing bodies include:

Each has distinct guidelines for the authorization and oversight of medical devices. The regulatory procedures generally encompass:

There is an increasing emphasis on aligning with international standards. Recent developments indicate a shift towards digitalization and streamlined processes, enhancing efficiency and compliance across the region.

As we approach 2025, these modifications are expected to facilitate quicker authorizations, with ethical clearances achievable in just 4-6 weeks, significantly accelerating the market entry for innovative medical technologies. Experts highlight that while challenges remain, such as oversight intricacy and varying endorsement timelines, ongoing initiatives aimed at harmonization and modernization are fostering a more unified framework when Latin America medical device regulations are compared.

Successful case studies, like Avantec Vascular's first-in-human clinical study supported by bioaccess™, exemplify how companies are adeptly navigating these regulations.

bioaccess™ provides comprehensive services, including:

This empowers startups to surmount challenges like regulatory hurdles and recruitment issues. By leveraging local collaborations and expertise, companies can expedite their validation timelines and enhance market access in this rapidly evolving environment.

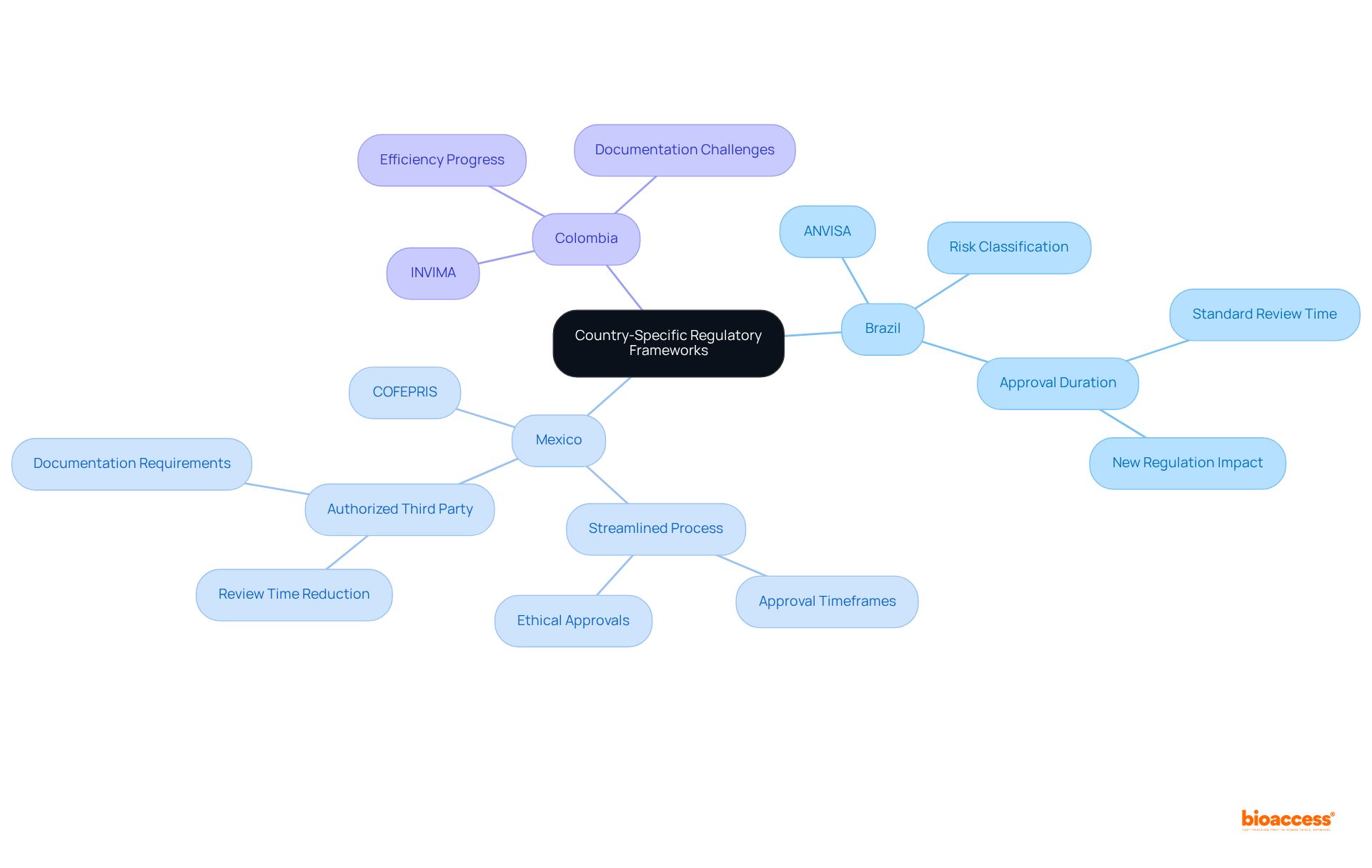

In Brazil, the medical equipment registration procedure is overseen by ANVISA, which employs a rigorous classification system based on risk levels. This process can extend over several months; however, recent changes have been instituted to expedite approvals, particularly for lower-risk items.

In contrast, Mexico's COFEPRIS has embraced a more streamlined approach, allowing registration times to be as brief as 4-6 weeks, especially for Class I low-risk devices. This efficiency is further augmented by the option for manufacturers to engage an Authorized Third Party, which can reduce review times to as little as 1-3 months.

Meanwhile, Colombia's INVIMA has made notable progress in enhancing its registration efficiency, yet it continues to face challenges concerning documentation and compliance.

Overall, while Brazil's governance structure is extensive and can be cumbersome, Latin America medical device regulations compared to those in Mexico and Colombia show that these countries are actively refining their operations, making them increasingly attractive for Medtech firms aiming to enter these markets.

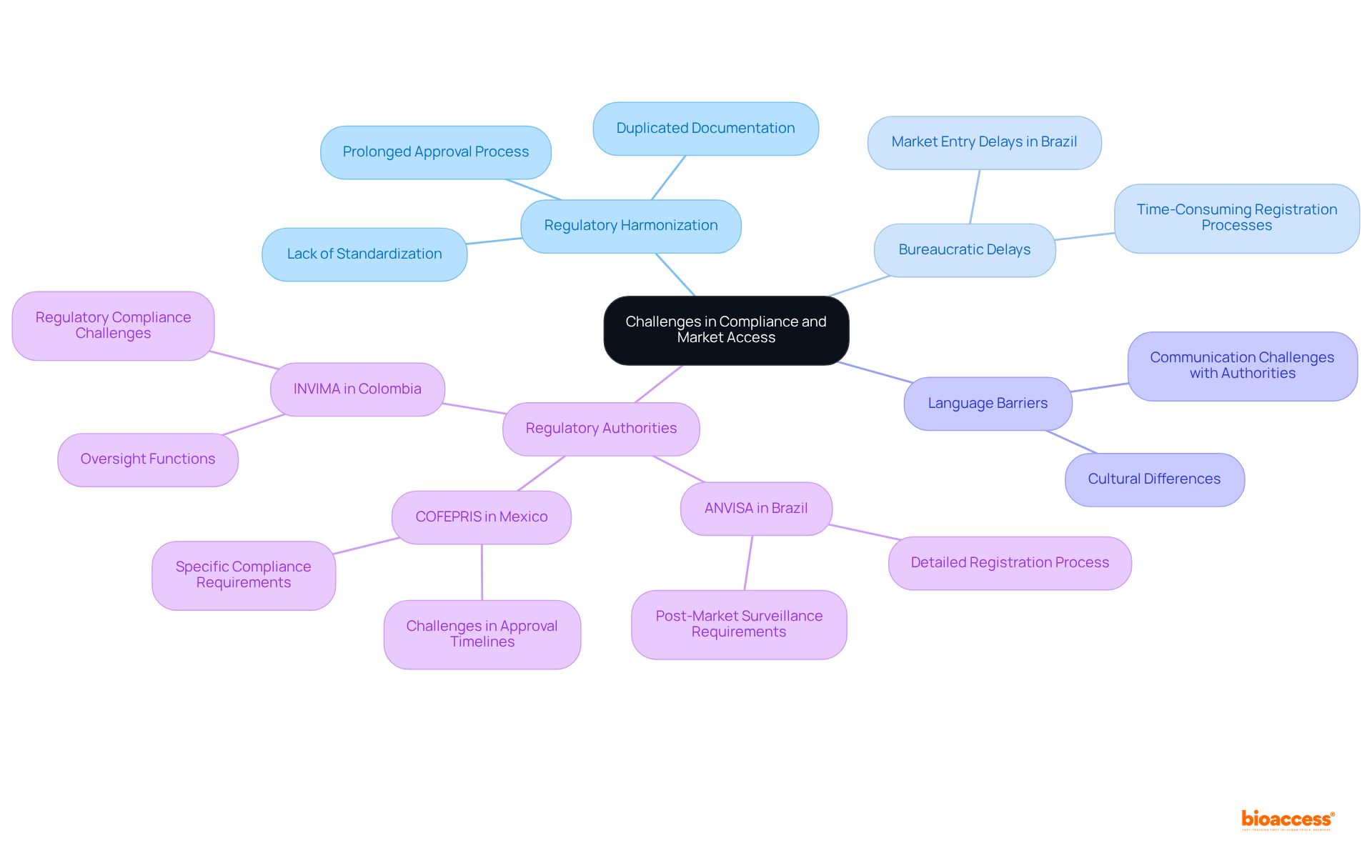

Despite notable advancements in governance frameworks, Medtech companies in Latin America continue to encounter significant challenges regarding compliance and market access when Latin America medical device regulations are compared to those in other regions. A primary issue is the lack of harmonization among countries when Latin America medical device regulations are compared, leading to duplicated documentation and testing efforts, which ultimately prolongs the approval process. Language barriers and cultural differences further complicate interactions with governing bodies, making effective communication a notable hurdle.

In Brazil, for instance, the bureaucratic landscape can result in substantial delays in market entry, highlighting the challenges for companies eager to introduce innovative medical technologies when Latin America medical device regulations are compared to other regions. Furthermore, the swiftly changing legal landscape, particularly with the rise of new technologies like software as a medical tool (SaMD), presents additional challenges for producers striving to meet local compliance standards.

As the medical device compliance affairs market in Latin America is projected to reach USD 446.2 million by 2030, addressing these market access challenges is essential for companies looking to capitalize on the region's growth potential, particularly when Latin America medical device regulations are compared to those in other regions.

When considering Latin America medical device regulations, regulatory authorities such as ANVISA in Brazil and COFEPRIS in Mexico play pivotal roles, necessitating that companies navigate their specific requirements to ensure compliance. Engaging local compliance experts, such as those at bioaccess®, can enhance understanding and facilitate smoother market entry.

bioaccess® provides comprehensive clinical trial management services, including Early-Feasibility Studies, First-In-Human Studies, Pilot Studies, and Post-Market Clinical Follow-Up Studies, which can significantly expedite the clinical trial process for Medtech, Biopharma, and Radiopharma startups in the region.

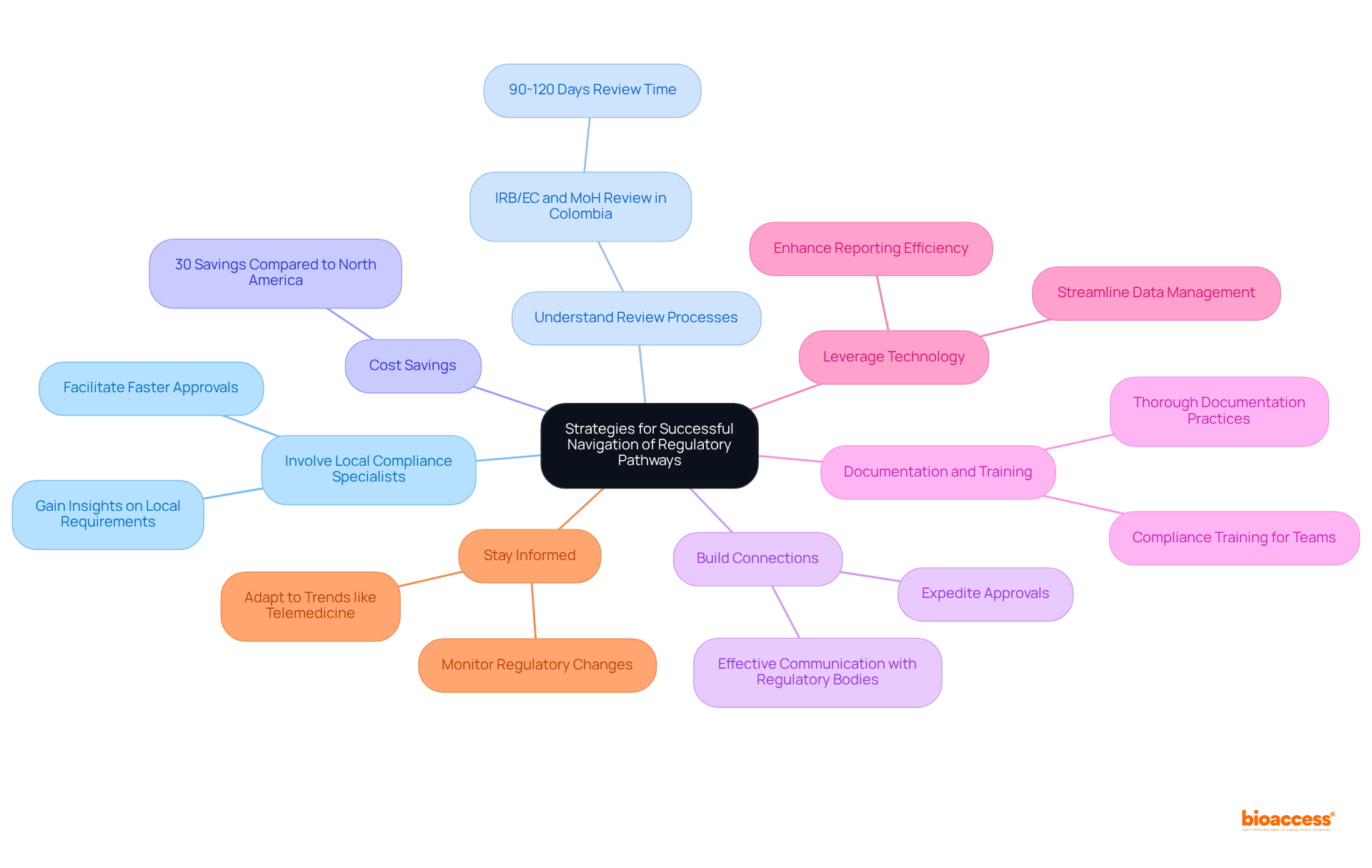

To successfully navigate the compliance pathways in Latin America, companies must consider several strategies. Involving local compliance specialists can provide invaluable insights into the specific requirements of each nation, especially given the anticipated growth of the LATAM medical devices market, projected at a CAGR of 5.87%, reaching US$49.51 billion by 2030.

For instance, in Colombia:

This comprehensive approach ultimately supports the successful commercialization of medical devices in Latin America, particularly when considering the Latin America medical device regulations compared, aligning with the organization's mission to advance medical devices sooner for companies in the Medtech, Biopharma, and Radiopharma sectors.

The intricate landscape of medical device regulations in Latin America reveals significant variations among countries, with distinct governing bodies and processes shaping the market. As nations like Brazil, Mexico, and Colombia refine their regulatory frameworks, a clear trend toward modernization and alignment with international standards emerges. This evolution aims to streamline the approval process, enhancing the efficiency with which innovative medical technologies can enter the market.

Key insights from the comparative analysis highlight both progress and ongoing challenges. While Brazil's ANVISA maintains a rigorous oversight structure, Mexico's COFEPRIS offers a more expedited registration process, particularly for low-risk devices. Colombia has made strides in efficiency but continues to face compliance hurdles. Despite these advancements, issues such as lack of harmonization, bureaucratic delays, and the complexities of adapting to new technologies persist as significant barriers for Medtech companies.

Navigating these regulatory pathways is of paramount importance. Companies aiming to capitalize on the projected growth of the Latin American medical device market must engage local compliance experts, adopt robust documentation practices, and leverage technology to enhance operational efficiency. By doing so, they can not only overcome regulatory challenges but also contribute to the region's evolving healthcare landscape, ultimately improving patient care and accessibility across Latin America.

What are the main regulatory bodies for medical devices in Latin America?

The key governing bodies for medical devices in Latin America include ANVISA in Brazil, COFEPRIS in Mexico, and INVIMA in Colombia.

What are the general regulatory procedures for medical devices in Latin America?

The regulatory procedures generally encompass classification, pre-market validation, and post-market monitoring of medical devices.

How is the regulatory landscape in Latin America evolving?

There is an increasing emphasis on aligning with international standards, with a shift towards digitalization and streamlined processes to enhance efficiency and compliance.

What changes are expected in medical device regulations by 2025?

Modifications are expected to facilitate quicker authorizations, with ethical clearances achievable in just 4-6 weeks, significantly accelerating the market entry for innovative medical technologies.

What challenges do companies face in navigating medical device regulations in Latin America?

Companies face challenges such as oversight intricacy and varying endorsement timelines; however, ongoing initiatives aim to harmonize and modernize the regulatory framework.

Can you provide an example of a successful case study in navigating these regulations?

A successful case study is Avantec Vascular's first-in-human clinical study, which was supported by bioaccess™.

What services does bioaccess™ provide to assist companies in the medical device sector?

bioaccess™ provides comprehensive services including site feasibility, investigator selection, trial set-up, project management, and regulatory compliance.

How does bioaccess™ empower startups in the medical device industry?

bioaccess™ empowers startups to overcome regulatory hurdles and recruitment issues by leveraging local collaborations and expertise, which helps expedite validation timelines and enhance market access.